Escrow Infrastructure for Enterprises

Escrow Infrastructure for Enterprises

Escrow Infrastructure for Enterprises

600+

Enterprise customers

10,000 +

Active Escrows

6,00,000 +

Escrow Transaction

12+ Banks

Banking Partners

6 Trustees

SEBI Authorised Trustee Partners

Top 6

Legal & Accounting Firms

600+

Enterprise customers

10,000 +

Active Escrows

6,00,000 +

Escrow transactions

12+ Banks

Banking partners

6 Trustees

SEBI authorised trustee partners

Top 6

Legal & accounting firms

Trusted by more than 600+ enterprises

Transforming the Escrow Experience

Escrow in a Bank + Trusteeship + Automated workflows = Escrow done right

By automating the escrow process and providing a user-friendly platform for managing transactions, Castler aims to make the process more efficient, secure, and convenient for organizations.

Our Offerings

Enterprise Escrow

Integrate your escrow with India's top banks using Castler's robust platform.

Transaction Banking Suite

Manage all your current & escrow account on a single platform.

Exclusive Label & On-Prem Solutions

Customize India’s largest escrow banking platform your way.

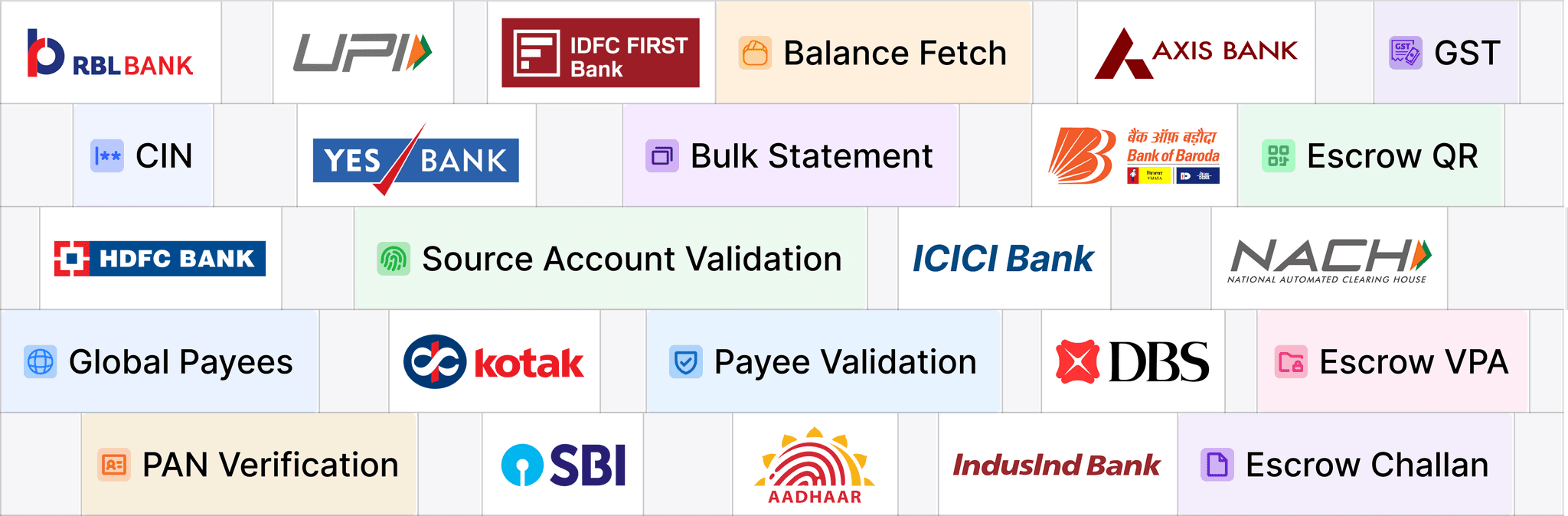

Our Capabilities

From Banks & NBFCs to Property Managers and the public sector, our solutions help hundreds of organisations provide a transformed client service offering and bring efficiency, speed and precision to their cash management operations.

Customizable approvable workflow management

Multi-bank | Multi- trustee

Seamless integration with APIs

Role based access control

Verified bulk payments

India’s first escrow banking TSP & API stack

Document management system & audit trail maintenance

Instant online payment transfers

Modular, flexible & secure transaction banking workflows

Automation of reconciliation and report management

Payouts to verified UPI VPAs

Automated payout modules

Customizable approvable workflow management

Multi-bank | Multi- trustee

Seamless integration with APIs

Role based access control

Verified bulk payments

India’s first escrow banking TSP & API stack

Document management system & audit trail maintenance

Instant online payment transfers

Modular, flexible & secure transaction banking workflows

Automation of reconciliation and report management

Payouts to verified UPI VPAs

Automated payout modules

Customizable approvable workflow management

Multi-bank | Multi- trustee

Seamless integration with APIs

Role based access control

View More

Plug & Play Modules

Any industry | Any usecase

Escrow banking is complex but Castler's modular, flexible & full stack solution makes it simple for you.

Investment Escrow

Angel syndicates

Share subscription

Buy back escrow

Secondary investments

Private placements

Marketplace

Agri marketplace

B2B & B2C marketplace

Insurance marketplace

Trading marketplace

Ecommerce

Quick commerce

Gig platforms

Formal giving platform

Used vehicle marketplace

Lending escrow

Digital lending

Traditional lending

Supply chain financing

P2P lending

Co-lending

Revenue based financing

Invoice discounting

BNPL

Unsecured lending

Cashflow collection

Lease rental discounting

Fintech escrow

Expense management

BBPS escrow

Payroll processing

Vendor payment

Payout escrow

Real estate escrow

RERA accounts

New project launch-EOI

Rental & security deposit

Landowner/developer escrow

Joint development escrow

Real estate resale transaction

Mergers & acquisition

Domestic mergers & acquisition

Cross-border mergers & acquisition

Deferred payment escrow

Indemnity escrow

Regulator mandated escrow

Payment aggregator escrow

PPI escrow

P2P escrow

Other Escrows

Profit sharing

Franchise-Franchisor

Dealer-Distributor

Dispute resolution

Litigation escrow

Liquidation

Investment Escrow

Angel syndicates

Share subscription

Buy back escrow

Secondary investments

Private placements

Marketplace

Agri marketplace

B2B & B2C marketplace

Insurance marketplace

Trading marketplace

Ecommerce

Quick commerce

Gig platforms

Formal giving platform

Used vehicle marketplace

Lending escrow

Digital lending

Traditional lending

Supply chain financing

P2P lending

Co-lending

Revenue based financing

Invoice discounting

BNPL

Unsecured lending

Cashflow collection

Lease rental discounting

Fintech escrow

Expense management

BBPS escrow

Payroll processing

Vendor payment

Payout escrow

Real estate escrow

RERA accounts

New project launch-EOI

Rental & security deposit

Landowner/developer escrow

Joint development escrow

Real estate resale transaction

Mergers & acquisition

Domestic mergers & acquisition

Cross-border mergers & acquisition

Deferred payment escrow

Indemnity escrow

Regulator mandated escrow

Payment aggregator escrow

PPI escrow

P2P escrow

Other Escrows

Profit sharing

Franchise-Franchisor

Dealer-Distributor

Dispute resolution

Litigation escrow

Liquidation

We Are India's Largest

Trust-as-a-Service Platform

If you are in these industries, consider Digital Identifier to safeguard your money!

15 months, 10 people & 1000 Cr monthly GTV: Castler is pioneering an emerging industry in India.

Ex-Razorpay VP Kumar Amit joins Castler as Co-founder & COO

Castler raises $5m from Capital 2B, IIFL and other India deals worth $63m.

Digital Identifier: Fast, Safe, Trustworthy.

Nithin Kamath-Owned Rainmatter, Others Back Fintech Startup Castler.

Capital 2B, IIFL Fintech Fund Lead $5 M Round For Zerodha-backed Castler

Castler to offer Digital Identifier services to Yes Bank customers

Castler Launches India’s First Escrow Management API Sandbox for Fintech Players

Startup News And Updates: Daily Roundup (May 2, 2023)

12+ Banks

Banking partners

6 Trustees

SEBI authorised trustee partners

Top 6

Legal & accounting firms

600+

Enterprise customers

10,000+

Active Escrows

6,00,000+

Escrow transactions

Banking Partners

ICICI Bank

DBS Bank

And more...

SEBI Authorised Trustee Partners

Backed By

We Are India's Largest

Trust-as-a-Service Platform

If you are in these industries, consider Digital Identifier to safeguard your money!

15 months, 10 people & 1000 Cr monthly GTV: Castler is pioneering an emerging industry in India.

Ex-Razorpay VP Kumar Amit joins Castler as Co-founder & COO

Castler raises $5m from Capital 2B, IIFL and other India deals worth $63m.

Digital Identifier: Fast, Safe, Trustworthy.

Nithin Kamath-Owned Rainmatter, Others Back Fintech Startup Castler.

Capital 2B, IIFL Fintech Fund Lead $5 M Round For Zerodha-backed Castler

Castler to offer Digital Identifier services to Yes Bank customers

Castler Launches India’s First Escrow Management API Sandbox for Fintech Players

Startup News And Updates: Daily Roundup (May 2, 2023)

12+ Banks

Banking partners

6 Trustees

SEBI authorised trustee partners

Top 6

Legal & accounting firms

600+

Enterprise customers

10,000+

Active Escrows

6,00,000+

Escrow transactions

Banking Partners

ICICI Bank

DBS Bank

And more...

SEBI Authorised Trustee Partners

Backed By

We Are India's Largest

Trust-as-a-Service Platform

If you are in these industries, consider Digital Identifier to safeguard your money!

15 months, 10 people & 1000 Cr monthly GTV: Castler is pioneering an emerging industry in India.

Ex-Razorpay VP Kumar Amit joins Castler as Co-founder & COO

Castler raises $5m from Capital 2B, IIFL and other India deals worth $63m.

Digital Identifier: Fast, Safe, Trustworthy.

Nithin Kamath-Owned Rainmatter, Others Back Fintech Startup Castler.

Capital 2B, IIFL Fintech Fund Lead $5 M Round For Zerodha-backed Castler

Castler to offer Digital Identifier services to Yes Bank customers

Castler Launches India’s First Escrow Management API Sandbox for Fintech Players

Startup News And Updates: Daily Roundup (May 2, 2023)

12+ Banks

Banking partners

6 Trustees

SEBI authorised trustee partners

Top 6

Legal & accounting firms

600+

Enterprise customers

10,000+

Active Escrows

6,00,000+

Escrow transactions

Banking Partners

ICICI Bank

DBS Bank

And more...

SEBI Authorised Trustee Partners

Backed By

What Our Clients Have To Say About Us

Castler's digital escrow services platform addresses crucial business needs in today's digitized landscape. Our newly launched service stands as a testament to Castler's ability to ensure secure and timely monetary transactions, meeting prevalent business requirements seamlessly. This partnership positions YES Bank and Castler at the forefront of Enterprise Escrow Banking, offering innovative solutions that simplify complexities and democratize digital escrow for widespread adoption among diverse customer segments.

Ajay Rajan

Country Head, Transaction Banking Group

Escrow banking is becoming an essential banking stack for many businesses and use cases. Castler is aiming to simplify and digitize escrow banking for mass adoption, making trust an implicit part of all digital transactions and smart contracts. Escrow is now becoming the core stack powering financial transactions across the value chain, providing an additional but crucial layer of security and transparency.

Vibhore Sharma

Partner at Capital 2B

Castler’s solution that combines Escrow, Trustee, and Transaction Tools is a game-changer for the banking industry. Its unique ability to offer solutions for both domestic and cross-border transactions opens a market worth hundreds of billions of dollars. We are thrilled to be a part of their mission to democratize Escrow Banking for consumers, SMEs, and Enterprises.

Mehekka Oberoi

Head of IIFL Fintech Fund

Castler is solving a real pain point around escrow account solutions, which have multiple use cases across financial transactions. We’re excited to partner with them.

Nithin Kamath

founder of Zerodha & Rainmatter

I was thoroughly impressed with their services. The staff was professional, responsive, and knowledgeable, and they made the entire process incredibly smooth and hassle-free.One of the things I appreciated most about Castler was their attention to detail. They were incredibly thorough in reviewing all of the necessary documents and ensuring that everything was in order before moving forward with the transaction. This gave me a lot of peace of mind and helped to prevent any potential issues or complications.

Nimith Agarwal

Co-Founder & CEO

I am thrilled to write a testimonial for Castler, a company that has truly transformed the way we handle digital payments and escrow agreements. Thanks to Castler, making digital payments has become incredibly easy and convenient for us. Their platform is intuitive, user-friendly, and secure, making it an ideal choice for anyone looking for a hassle-free payment experience.

Prashanth

Finance manager

I liked the features like, 100% Security through Escrow Agreement, Modular Product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective, help you save time, money effort.

Dipen Patel

CTO

Castler’s team of skilled professionals quickly understands the latest digital strategies, enabling us with tailored solutions to our unique needs. Their team was always available to answer any questions or concerns. And I also liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective.

Pradeep

CEO & Co-Founder

The process of disbursal through Castler is quick, easy and reliable. The best thing about them is the their team, which is readily available to assist you and give solution to your queries or even helping with last minute disbursal requests. And I also liked the features like unified dashboard, 100% security through escrow agreement, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Rahul Singh

Finance Lead

Quick response time. And I also liked the features like, multi-bank option, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Sanu Kumar

Program Manager

Keep up the good work and try to add more features related to operational convenience. And I also liked the features like, unified dashboard, 100% security through escrow agreement, standardized pricing, help you save time, money & effort.

Nitish Kumar Gupta

Senior Director

I liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end Support, efficient & effective, help you save time, money & effort.

Amruta Shingweka

Founder

What Our Clients Have To Say About Us

Castler's digital escrow services platform addresses crucial business needs in today's digitized landscape. Our newly launched service stands as a testament to Castler's ability to ensure secure and timely monetary transactions, meeting prevalent business requirements seamlessly. This partnership positions YES Bank and Castler at the forefront of Enterprise Escrow Banking, offering innovative solutions that simplify complexities and democratize digital escrow for widespread adoption among diverse customer segments.

Ajay Rajan

Country Head, Transaction Banking Group

Escrow banking is becoming an essential banking stack for many businesses and use cases. Castler is aiming to simplify and digitize escrow banking for mass adoption, making trust an implicit part of all digital transactions and smart contracts. Escrow is now becoming the core stack powering financial transactions across the value chain, providing an additional but crucial layer of security and transparency.

Vibhore Sharma

Partner at Capital 2B

Castler’s solution that combines Escrow, Trustee, and Transaction Tools is a game-changer for the banking industry. Its unique ability to offer solutions for both domestic and cross-border transactions opens a market worth hundreds of billions of dollars. We are thrilled to be a part of their mission to democratize Escrow Banking for consumers, SMEs, and Enterprises.

Mehekka Oberoi

Head of IIFL Fintech Fund

Castler is solving a real pain point around escrow account solutions, which have multiple use cases across financial transactions. We’re excited to partner with them.

Nithin Kamath

founder of Zerodha & Rainmatter

I was thoroughly impressed with their services. The staff was professional, responsive, and knowledgeable, and they made the entire process incredibly smooth and hassle-free.One of the things I appreciated most about Castler was their attention to detail. They were incredibly thorough in reviewing all of the necessary documents and ensuring that everything was in order before moving forward with the transaction. This gave me a lot of peace of mind and helped to prevent any potential issues or complications.

Nimith Agarwal

Co-Founder & CEO

I am thrilled to write a testimonial for Castler, a company that has truly transformed the way we handle digital payments and escrow agreements. Thanks to Castler, making digital payments has become incredibly easy and convenient for us. Their platform is intuitive, user-friendly, and secure, making it an ideal choice for anyone looking for a hassle-free payment experience.

Prashanth

Finance manager

I liked the features like, 100% Security through Escrow Agreement, Modular Product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective, help you save time, money effort.

Dipen Patel

CTO

Castler’s team of skilled professionals quickly understands the latest digital strategies, enabling us with tailored solutions to our unique needs. Their team was always available to answer any questions or concerns. And I also liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective.

Pradeep

CEO & Co-Founder

The process of disbursal through Castler is quick, easy and reliable. The best thing about them is the their team, which is readily available to assist you and give solution to your queries or even helping with last minute disbursal requests. And I also liked the features like unified dashboard, 100% security through escrow agreement, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Rahul Singh

Finance Lead

Quick response time. And I also liked the features like, multi-bank option, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Sanu Kumar

Program Manager

Keep up the good work and try to add more features related to operational convenience. And I also liked the features like, unified dashboard, 100% security through escrow agreement, standardized pricing, help you save time, money & effort.

Nitish Kumar Gupta

Senior Director

I liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end Support, efficient & effective, help you save time, money & effort.

Amruta Shingweka

Founder

Backed by Enterprise-Grade Security

PCI-DSS Level 1 Compliant

We adhere to the highest level of security standards for handling and ensure secure processing and storage.

SOC-II (Under Implementation)

We ensure trust and compliance in data handling practices.

ISO 27001 (Under Implementation)

We ensure secure and efficient transactions across our platforms and systems.

Backed by Enterprise-Grade Security

PCI-DSS Level 1 Compliant

We adhere to the highest level of security standards for handling and ensure secure processing and storage.

SOC-II (Under Implementation)

We ensure trust and compliance in data handling practices.

ISO 27001 (Under Implementation)

We ensure secure and efficient transactions across our platforms and systems.

Frequently Asked Questions

What is the benefit of using an escrow account?

What is escrow banking?

What type of solutions are offered by Castler in escrow banking?

How can I ensure payment safety using Castler’s solution?

Which banks are available to open an escrow?

How can enterprise start their escrow journey?

How can I open an escrow account?

When is an escrow account typically used?

How does an escrow account work?

What is escrow?

Frequently Asked Questions

What is the benefit of using an escrow account?

What is escrow banking?

What type of solutions are offered by Castler in escrow banking?

How can I ensure payment safety using Castler’s solution?

Which banks are available to open an escrow?

How can enterprise start their escrow journey?

How can I open an escrow account?

When is an escrow account typically used?

How does an escrow account work?

What is escrow?

Frequently Asked Questions

What is the benefit of using an escrow account?

What is escrow banking?

What type of solutions are offered by Castler in escrow banking?

How can I ensure payment safety using Castler’s solution?

Which banks are available to open an escrow?

How can enterprise start their escrow journey?

How can I open an escrow account?

When is an escrow account typically used?

How does an escrow account work?

What is escrow?

India's Largest Escrow-as-a-Service Platform

Escrow account services are complex but Castler's modular, flexible & full stack solution makes it simple for you.

Castler automates the Escrow account management and improves the user experience for managing payments and settlements. By leveraging technology to streamline these transactions, Castler makes the process more efficient, secure and convenient for its users

India's Leading Escrow Company.

Escrow Banking

Investment Escrow

Marketplace

Lending escrow

Fintech escrow

Mergers & acquisition

Regulator mandated escrow

Profit sharing

Franchisor-Franchisee

Dealer-Distributor

Dispute resolution

Litigation escrow

Liquidation

Software Escrow

Copyright @2025 Castler (Ncome Tech Solutions Pvt. Ltd.) All rights reserved | Made in India 🇮🇳

India's Largest Escrow-as-a-Service Platform

Escrow account services are complex but Castler's modular, flexible & full stack solution makes it simple for you.

Castler automates the Escrow account management and improves the user experience for managing payments and settlements. By leveraging technology to streamline these transactions, Castler makes the process more efficient, secure and convenient for its users

India's Leading Escrow Company.

Escrow Banking

Investment Escrow

Marketplace

Lending escrow

Fintech escrow

Mergers & acquisition

Regulator mandated escrow

Profit sharing

Franchisor-Franchisee

Dealer-Distributor

Dispute resolution

Litigation escrow

Liquidation

Software Escrow

India's Largest Escrow-as-a-Service Platform

Escrow account services are complex but Castler's modular, flexible & full stack solution makes it simple for you.

Castler automates the Escrow account management and improves the user experience for managing payments and settlements. By leveraging technology to streamline these transactions, Castler makes the process more efficient, secure and convenient for its users

India's Leading Escrow Company.

Escrow Banking

Investment Escrow

Marketplace

Lending escrow

Fintech escrow

Mergers & acquisition

Regulator mandated escrow

Profit sharing

Franchisor-Franchisee

Dealer-Distributor

Dispute resolution

Litigation escrow

Liquidation

Software Escrow

What Our Clients Have To Say About Us

Castler's digital escrow services platform addresses crucial business needs in today's digitized landscape. Our newly launched service stands as a testament to Castler's ability to ensure secure and timely monetary transactions, meeting prevalent business requirements seamlessly. This partnership positions YES Bank and Castler at the forefront of Enterprise Escrow Banking, offering innovative solutions that simplify complexities and democratize digital escrow for widespread adoption among diverse customer segments.

Ajay Rajan

Country Head, Transaction Banking Group

Escrow banking is becoming an essential banking stack for many businesses and use cases. Castler is aiming to simplify and digitize escrow banking for mass adoption, making trust an implicit part of all digital transactions and smart contracts. Escrow is now becoming the core stack powering financial transactions across the value chain, providing an additional but crucial layer of security and transparency.

Vibhore Sharma

Partner at Capital 2B

Castler’s solution that combines Escrow, Trustee, and Transaction Tools is a game-changer for the banking industry. Its unique ability to offer solutions for both domestic and cross-border transactions opens a market worth hundreds of billions of dollars. We are thrilled to be a part of their mission to democratize Escrow Banking for consumers, SMEs, and Enterprises.

Mehekka Oberoi

Head of IIFL Fintech Fund

Castler is solving a real pain point around escrow account solutions, which have multiple use cases across financial transactions. We’re excited to partner with them.

Nithin Kamath

founder of Zerodha & Rainmatter

I was thoroughly impressed with their services. The staff was professional, responsive, and knowledgeable, and they made the entire process incredibly smooth and hassle-free.One of the things I appreciated most about Castler was their attention to detail. They were incredibly thorough in reviewing all of the necessary documents and ensuring that everything was in order before moving forward with the transaction. This gave me a lot of peace of mind and helped to prevent any potential issues or complications.

Nimith Agarwal

Co-Founder & CEO

I am thrilled to write a testimonial for Castler, a company that has truly transformed the way we handle digital payments and escrow agreements. Thanks to Castler, making digital payments has become incredibly easy and convenient for us. Their platform is intuitive, user-friendly, and secure, making it an ideal choice for anyone looking for a hassle-free payment experience.

Prashanth

Finance manager

I liked the features like, 100% Security through Escrow Agreement, Modular Product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective, help you save time, money effort.

Dipen Patel

CTO

Castler’s team of skilled professionals quickly understands the latest digital strategies, enabling us with tailored solutions to our unique needs. Their team was always available to answer any questions or concerns. And I also liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective.

Pradeep

CEO & Co-Founder

The process of disbursal through Castler is quick, easy and reliable. The best thing about them is the their team, which is readily available to assist you and give solution to your queries or even helping with last minute disbursal requests. And I also liked the features like unified dashboard, 100% security through escrow agreement, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Rahul Singh

Finance Lead

Quick response time. And I also liked the features like, multi-bank option, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Sanu Kumar

Program Manager

Keep up the good work and try to add more features related to operational convenience. And I also liked the features like, unified dashboard, 100% security through escrow agreement, standardized pricing, help you save time, money & effort.

Nitish Kumar Gupta

Senior Director

I liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end Support, efficient & effective, help you save time, money & effort.

Amruta Shingweka

Founder

What Our Clients Have To Say About Us

Castler's digital escrow services platform addresses crucial business needs in today's digitized landscape. Our newly launched service stands as a testament to Castler's ability to ensure secure and timely monetary transactions, meeting prevalent business requirements seamlessly. This partnership positions YES Bank and Castler at the forefront of Enterprise Escrow Banking, offering innovative solutions that simplify complexities and democratize digital escrow for widespread adoption among diverse customer segments.

Ajay Rajan

Country Head, Transaction Banking Group

Escrow banking is becoming an essential banking stack for many businesses and use cases. Castler is aiming to simplify and digitize escrow banking for mass adoption, making trust an implicit part of all digital transactions and smart contracts. Escrow is now becoming the core stack powering financial transactions across the value chain, providing an additional but crucial layer of security and transparency.

Vibhore Sharma

Partner at Capital 2B

Castler’s solution that combines Escrow, Trustee, and Transaction Tools is a game-changer for the banking industry. Its unique ability to offer solutions for both domestic and cross-border transactions opens a market worth hundreds of billions of dollars. We are thrilled to be a part of their mission to democratize Escrow Banking for consumers, SMEs, and Enterprises.

Mehekka Oberoi

Head of IIFL Fintech Fund

Castler is solving a real pain point around escrow account solutions, which have multiple use cases across financial transactions. We’re excited to partner with them.

Nithin Kamath

founder of Zerodha & Rainmatter

I was thoroughly impressed with their services. The staff was professional, responsive, and knowledgeable, and they made the entire process incredibly smooth and hassle-free.One of the things I appreciated most about Castler was their attention to detail. They were incredibly thorough in reviewing all of the necessary documents and ensuring that everything was in order before moving forward with the transaction. This gave me a lot of peace of mind and helped to prevent any potential issues or complications.

Nimith Agarwal

Co-Founder & CEO

I am thrilled to write a testimonial for Castler, a company that has truly transformed the way we handle digital payments and escrow agreements. Thanks to Castler, making digital payments has become incredibly easy and convenient for us. Their platform is intuitive, user-friendly, and secure, making it an ideal choice for anyone looking for a hassle-free payment experience.

Prashanth

Finance manager

I liked the features like, 100% Security through Escrow Agreement, Modular Product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective, help you save time, money effort.

Dipen Patel

CTO

Castler’s team of skilled professionals quickly understands the latest digital strategies, enabling us with tailored solutions to our unique needs. Their team was always available to answer any questions or concerns. And I also liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end support, efficient & effective.

Pradeep

CEO & Co-Founder

The process of disbursal through Castler is quick, easy and reliable. The best thing about them is the their team, which is readily available to assist you and give solution to your queries or even helping with last minute disbursal requests. And I also liked the features like unified dashboard, 100% security through escrow agreement, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Rahul Singh

Finance Lead

Quick response time. And I also liked the features like, multi-bank option, team responsiveness, end-to-end support, efficient & effective, help you save time, money & effort .

Sanu Kumar

Program Manager

Keep up the good work and try to add more features related to operational convenience. And I also liked the features like, unified dashboard, 100% security through escrow agreement, standardized pricing, help you save time, money & effort.

Nitish Kumar Gupta

Senior Director

I liked the features like, unified dashboard, modular product, fully customizable, any industry any use-case, team responsiveness, end-to-end Support, efficient & effective, help you save time, money & effort.

Amruta Shingweka

Founder

Backed by Enterprise-Grade Security

PCI-DSS Level 1 Compliant

We adhere to the highest level of security standards for handling and ensure secure processing and storage.

SOC-II (Under Implementation)

We ensure trust and compliance in data handling practices.

ISO 27001 (Under Implementation)

We ensure secure and efficient transactions across our platforms and systems.

Backed by Enterprise-Grade Security

PCI-DSS Level 1 Compliant

We adhere to the highest level of security standards for handling and ensure secure processing and storage.

SOC-II (Under Implementation)

We ensure trust and compliance in data handling practices.

ISO 27001 (Under Implementation)

We ensure secure and efficient transactions across our platforms and systems.